塑料圈的朋友都在关注的微信公众号——艾邦高分子,戳蓝色字体关注吧!

小编观点:

细说陶氏杜邦两大豪门的联姻:陶氏成立于1897年,是全球农药最重要的农药供应商,2015年销售额超过540亿美元;杜邦成立于1802年,靠火药起家,2015年销售额超过280亿美元。两家同出自豪门望族,此次“联姻”属于强强联手,是否有垄断的嫌疑尚待观察。

未来,两大豪门将计划生育“两女一男”,“大女儿”材料公司、“二女儿”农业公司、“小儿子”特种产品公司。他们在未来计划中将先后上市,而“小儿子”特种产品公司有可能会是重点培养的对象。两家巨头涉及广泛,在全球化工行业整体颓废的形势下,通过合并,生下三子(农业、材料和特种产品),资源整合、精细划分,以寻求新的突破。

陶氏化学、杜邦主营业务一览表(合并前):

陶氏 | 杜邦 |

农业 | 先锋良种、植物保护、 |

建筑材料 | 建筑创新 |

消费品 | 营养与健康 |

电子材料 | 电子与通讯 |

包装材料 | 包装与工业聚合物 |

水处理 | 应用化学及氟产品 |

涂料和基础设施 | 防护技术 |

汽车材料 | 可持续解决方案 |

…… | 高性能聚合物 |

钛白粉 | |

…… |

艾邦高分子原创整理

新闻:杜邦与陶氏化学正式宣布平等合并

12月11日,陶氏化学与杜邦正式宣布达成平等合并协议,合并后的公司将被命名为陶氏杜邦公司(DowDuPont),成为全球最大化学品公司,市值1300亿美元。合并后,公司年销售额将达到830亿美元,其中陶氏超过540亿,杜邦超过280亿。

Midland, Mich.-based Dow and DuPont of Wilmington, Del., two global chemical companies with major plastics businesses, announced on Dec. 11 that they will be combining in a merger of equals. A combined DowDuPont — as the firm will be known — will have annual sales of around $83 billion, with a little more than $54 billion coming from Dow and just over $28 billion from DuPont. |

DuPont's Edward Breen and Dow Andrew Liveris shake hands as the merger announcement between the two firms is announced Dec. 11.

陶氏化学CEO利伟诚(Andrew Liveris)将担任合并后公司的董事长,杜邦CEO埃德-布林(Ed Breen)将担任新公司的CEO。

Dow President, Chairman and CEO Andrew Liveris will serve as executive chairman of the new firm. DuPont CEO and Chairman Edward Breen — who joined the firm’s board earlier this year and became CEO in October — will be CEO of DowDuPont. |

利伟诚表示:"此项交易将改变化学行业的游戏规则,十多年来我们一直希望将这两个强大的创新和材料科学领袖结合在一起,这一愿望终于得以实现。"

合并后的公司未来将寻求分拆为三家独立的上市公司,分别专注于农业、材料和特种产品。计划在合并完成后18-24个月内完成。分拆后的材料公司将成为三家公司最大的一家,而塑料业务将归属此公司。利伟诚将亲自统领该材料公司。他表示,材料公司约七成的销售额将来自于包装、交通和基础设施这三个主要的领域。

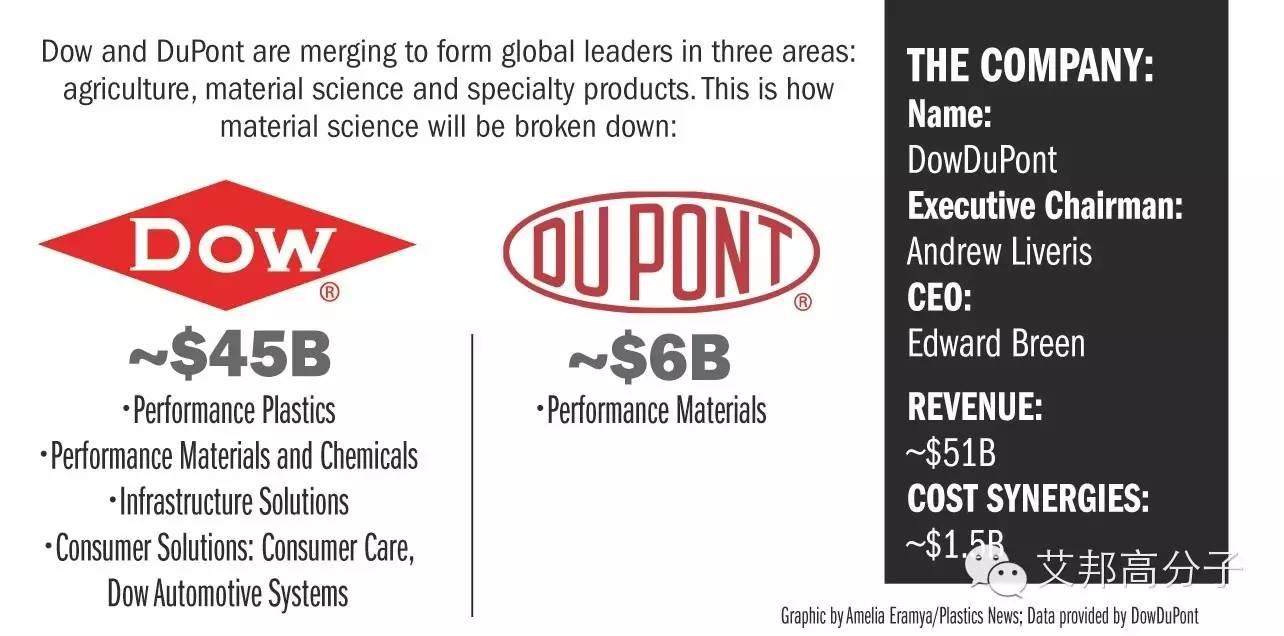

DowDuPont then in the next 18-24 months will be split into three separate public companies in order to better capitalize on growth opportunities. Plastics units will be contained in a material science company that by far will be the largest of the three with annual sales of $51 billion. Liveris will lead the material science firm in addition to his role of executive chairman. He said that about 70 percent of the materials company’s sales will come from three key end markets — packaging, transportation and construction. |

这是全球化工行业史上最大的一起合并重组交易。

此次合并有望给两家巨头带来每年30亿美元的成本优化。新集团将拥有两个总部,分别是陶氏和杜邦的现有总部。

根据交易条款,杜邦股东手中每股股票将可获得1.282股陶氏杜邦股票,陶氏股东手中每股股票可获得1股陶氏杜邦股票。两公司将各持50%股份。

此项交易可能面临反垄断监管机构的严格审查。不过,分析师认为,尽管此项交易规模巨大且极其复杂,但仍可能在不需要出售太多资产的情况下获得监管批准。

The material science firm will improve the combined firm’s cost position by leveraging Dow’s platform in low cost feedstocks, officials said. It also will enhance opportunities to cross-sell in a number of key markets, including packaging, transportation and infrastructure solutions. An agricultural company will have annual sales of $19 billion and a specialty products company will have annual sales of $13 billion. Dow shareholders will receive one share in DuPontDow for each Dow share they own. DuPont shareholders will get 1.282 shares in the new firm for each DuPont share. The combination is expected to create annual cost savings of $3 billion. The combined firm also will continue to maintain headquarters in both Midland and Wilmington. Both companies have been under pressure from activist investors who have argued that the companies’ stocks were underperforming. |

新闻来源:Plastic News

艾邦高分子节选翻译

推荐阅读:

回复【杜邦】或【陶氏】,查看更多

加入“艾邦高分子外企交流群”,请加微信:18320928915或15712009605,并注明“外企+公司”

阅读原文,加入艾邦高分子外企交流群

↓↓↓

始发于微信公众号:艾邦高分子